Get started as seller

What do you need to started as seller?

- PAN PAN number is mandatory for tax purposes and should be in the name of the business. In case of sole proprietorship, the PAN card of the seller needs to be submitted.

- GSTIN GSTIN or GST Identification Number is a tax registration number under GST. The Government of India has made it mandatory to run an ecommerce business to avoid loss of business in Tax Credits.

How to sell

Click On The Vendor Registration Link And Register As A Vendor.

Enter Your Basic Information, Including your Store Name

Provide bank account details for receiving payment

Read and accept - Accept The Service Fee Agreement

Upload Your Products on Unati.in With Relevant Details. A minimum of 10 Products To Make Your Store Live.

That’s it, you have just uncovered one of the many opportunities for becoming an entrepreneur.

Whatever be the reason, you are at the right place, unati.in!! Start selling

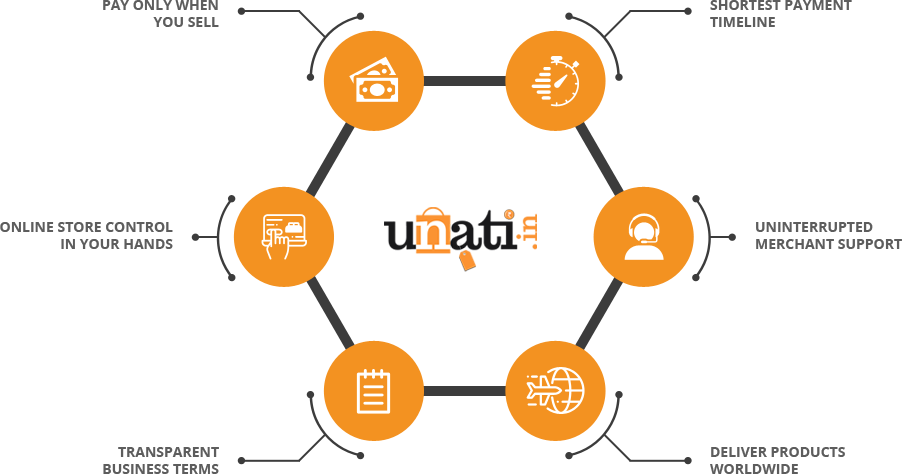

Why unati

- Almost Nil Investment: To sell on Unati, not only a seller doesn’t need a brick and mortar store, but other things such as staff recruitment and marketing become needless.

- Payments are Easy, Fast, and On-Time: You don’t need to wait longer than expected, if you’re selling on Unati! Unati’s payment is the fastest in the industry and seller may get the payment in the 7 working days*

- Unati’s Reach is Extraordinary: Unati has an extremely massive reach and it takes products to every corner of India or anywhere in world. For taking the products in any part of world, Unati is the marketplace that can help the sellers immensely. Its huge visitors and buyers can make a product a huge success.

** Payments will be done on the basis of billing cycle and payment clearance from the customer